Multiple Choice

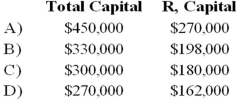

RD formed a partnership on February 10, 20X9. R contributed cash of $150,000, while D contributed inventory with a fair value of $120,000. Due to R's expertise in selling, D agreed that R should have 60 percent of the total capital of the partnership. R and D agreed to recognize goodwill. What is the total capital of the RD partnership and the capital balance of R after the goodwill is recognized?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q8: When a partner retires from a partnership

Q13: In the JAW partnership,Jane's capital is $100,000,Anne's

Q17: In the AD partnership, Allen's capital is

Q18: In the AD partnership, Allen's capital is

Q21: The DEF partnership reported net income of

Q23: The JPB partnership reported net income of

Q25: In the AD partnership, Allen's capital is

Q35: Shue,a partner in the Financial Brokers Partnership,has

Q41: Paul and Ray sell musical instruments through

Q68: When a new partner is admitted into