Multiple Choice

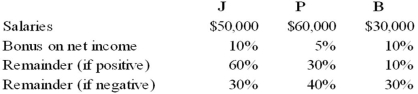

The JPB partnership reported net income of $160,000 for the year ended December 31, 20X8. According to the partnership agreement, partnership profits and losses are to be distributed as follows:  How should partnership net income for 20X8 be allocated to J, P, and B?

How should partnership net income for 20X8 be allocated to J, P, and B?

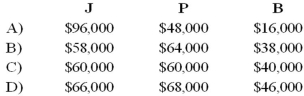

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q18: In the AD partnership, Allen's capital is

Q20: RD formed a partnership on February 10,

Q21: The DEF partnership reported net income of

Q25: In the AD partnership, Allen's capital is

Q27: Two sole proprietors, L and M, agreed

Q35: Shue,a partner in the Financial Brokers Partnership,has

Q41: Paul and Ray sell musical instruments through

Q50: The partnership of X and Y shares

Q52: The ABC partnership had net income of

Q68: When a new partner is admitted into