Multiple Choice

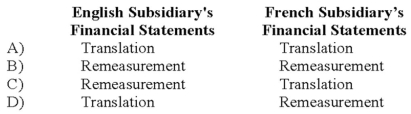

Simon Company has two foreign subsidiaries. One is located in France, the other in England. Simon has determined the U.S. dollar is the functional currency for the French subsidiary, while the British pound is the functional currency for the English subsidiary. Both subsidiaries maintain their books and records in their respective local currencies. What methods will Simon use to convert each of the subsidiary's financial statements into U.S. dollars?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following describes a situation

Q3: The assets listed below of a foreign

Q4: On January 2, 20X8, Johnson Company acquired

Q5: On January 1, 20X8, Transport Corporation acquired

Q6: Infinity Corporation acquired 80 percent of the

Q8: Michigan-based Leo Corporation acquired 100 percent of

Q9: On January 2, 20X8, Johnson Company acquired

Q10: Which combination of accounts and exchange rates

Q12: All of the following describe the International

Q12: Note: This is a Kaplan CPA Review