Multiple Choice

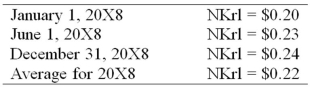

On January 1, 20X8, Transport Corporation acquired 75 percent interest in Steamship Company for $300,000. Steamship is a Norwegian company. The local currency is the Norwegian kroner (NKr) . The acquisition resulted in an excess of cost-over-book value of $25,000 due solely to a patent having a remaining life of 5 years. Transport uses the fully adjusted equity method to account for its investment. Steamship's December 31, 20X8, trial balance has been translated into U.S. dollars, requiring a translation adjustment debit of $8,000. Steamship's net income translated into U.S. dollars is $35,000. It declared and paid an NKr 20,000 dividend on June 1, 20X8. Relevant exchange rates are as follows:  Assume the kroner is the functional currency.

Assume the kroner is the functional currency.

Based on the preceding information, in the journal entry to record parent's share of subsidiary's translation adjustment:

A) Other Comprehensive Income-Translation Adjustment will be debited for $8,000.

B) Other Comprehensive Income-Translation Adjustment will be credited for $6,000.

C) Investment in Steamship Company will be credited for $6,000.

D) Investment in Steamship Company will be debited for $8,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: On January 2, 20X8, Johnson Company acquired

Q2: Which of the following describes a situation

Q3: The assets listed below of a foreign

Q4: On January 2, 20X8, Johnson Company acquired

Q6: Infinity Corporation acquired 80 percent of the

Q7: Simon Company has two foreign subsidiaries. One

Q8: Michigan-based Leo Corporation acquired 100 percent of

Q9: On January 2, 20X8, Johnson Company acquired

Q10: Which combination of accounts and exchange rates

Q12: All of the following describe the International