Multiple Choice

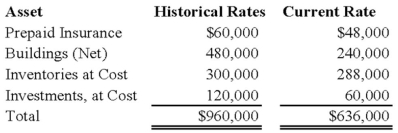

The assets listed below of a foreign subsidiary have been converted to U.S. dollars at both current and historical exchange rates. Assuming that the local currency of the foreign subsidiary is the functional currency, what total amount should appear for these assets on the U.S. company's consolidated balance sheet?

A) $636,000

B) $648,000

C) $708,000

D) $960,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: On January 2, 20X8, Johnson Company acquired

Q2: Which of the following describes a situation

Q4: On January 2, 20X8, Johnson Company acquired

Q5: On January 1, 20X8, Transport Corporation acquired

Q6: Infinity Corporation acquired 80 percent of the

Q7: Simon Company has two foreign subsidiaries. One

Q8: Michigan-based Leo Corporation acquired 100 percent of

Q9: On January 2, 20X8, Johnson Company acquired

Q10: Which combination of accounts and exchange rates

Q12: All of the following describe the International