Essay

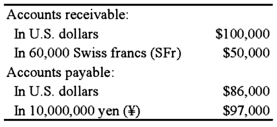

Quantum Company imports goods from different countries. Some transactions are denominated in U.S. dollars and others in foreign currencies. A summary of accounts receivable and accounts payable on December 31, 20X8, before adjustments for the effects of changes in exchange rates during 20X8, follows:

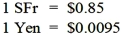

The spot rates on December 31, 20X8, were:

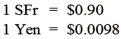

The average exchange rates during the collection and payment period in 20X9 are:

Required:

1) Prepare the adjusting entries on December 31, 20X8.

2) Record the collection of the accounts receivable and the payment of the accounts payable in 20X9.

3) What was the foreign currency gain or loss on the accounts receivable transaction denominated in SFr for the year ended December 31, 20X8? For the year ended December 31, 20X9? Overall for this transaction?

4) What was the foreign currency gain or loss on the accounts receivable transaction denominated in ¥? For the year ended December 31, 20X8? For the year ended December 31, 20X9? Overall for this transaction?

Correct Answer:

Verified

Correct Answer:

Verified

Q5: On December 5, 20X8, Texas based Imperial

Q6: Levin company entered into a forward contract

Q7: Note: This is a Kaplan CPA Review

Q8: Myway Company sold equipment to a Canadian

Q9: Which of the following observations is true

Q11: Taste Bits Inc. purchased chocolates from Switzerland

Q12: Taste Bits Inc. purchased chocolates from Switzerland

Q13: Detroit based Auto Corporation, purchased ancillaries from

Q14: Taste Bits Inc. purchased chocolates from Switzerland

Q15: On December 1, 20X8, Hedge Company entered