Multiple Choice

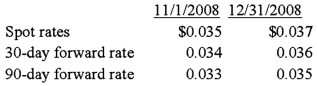

Levin company entered into a forward contract to speculate in the foreign currency. It sold 100,000 foreign currency units under a contract dated November 1, 20X8, for delivery on January 31, 20X9:  In its income statement for the year ended December 31, 20X8, what amount of loss should Levin report from this forward contract?

In its income statement for the year ended December 31, 20X8, what amount of loss should Levin report from this forward contract?

A) $0

B) $300

C) $200

D) $100

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Spiralling crude oil prices prompted AMAR Company

Q2: On September 3, 20X8, Jackson Corporation purchases

Q3: On December 1, 20X8, Winston Corporation acquired

Q4: On December 1, 20X8, Winston Corporation acquired

Q5: On December 5, 20X8, Texas based Imperial

Q7: Note: This is a Kaplan CPA Review

Q8: Myway Company sold equipment to a Canadian

Q9: Which of the following observations is true

Q10: Quantum Company imports goods from different countries.

Q11: Taste Bits Inc. purchased chocolates from Switzerland