Multiple Choice

Note: This is a Kaplan CPA Review Question

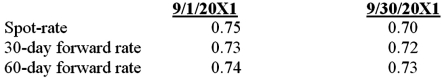

On September 1, 20X1, Brady Corp. entered into a foreign exchange contract for speculative purposes by purchasing 50,000 deutsche marks for delivery in 60 days. The rates to exchange $1 for 1 deutsche mark follow:

In its September 30, 20X1 income statement, what amount should Brady report as foreign exchange loss?

A) $1,000

B) $2,500

C) $1,500

D) $500

Correct Answer:

Verified

Correct Answer:

Verified

Q2: On September 3, 20X8, Jackson Corporation purchases

Q3: On December 1, 20X8, Winston Corporation acquired

Q4: On December 1, 20X8, Winston Corporation acquired

Q5: On December 5, 20X8, Texas based Imperial

Q6: Levin company entered into a forward contract

Q8: Myway Company sold equipment to a Canadian

Q9: Which of the following observations is true

Q10: Quantum Company imports goods from different countries.

Q11: Taste Bits Inc. purchased chocolates from Switzerland

Q12: Taste Bits Inc. purchased chocolates from Switzerland