Short Answer

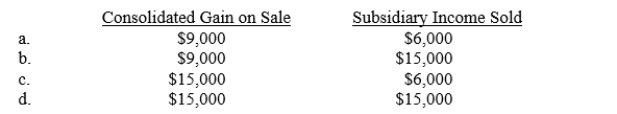

P Corporation purchased an 80% interest in S Corporation on January 1, 2013, at book value for $300,000.S's net income for 2013 was $90,000 and no dividends were declared.On May 1, 2013, P reduced its interest in S by selling a 20% interest, or one-fourth of its investment for $90,000.What will be the Consolidated Gain on Sale and Subsidiary Income Sold for 2013?

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Partner Company acquired 85% of the common

Q7: Parr Company owned 24,000 of the 30,000

Q9: Pratt Company purchased 40,000 shares of Silas

Q11: Which one of the following statements regarding

Q11: P Company purchased 96,000 shares of the

Q12: On January 1 2013, Paulus Company purchased

Q13: On January 1, 2009, Pine Corporation purchased

Q14: On January 1, 2011, Panel Company acquired

Q15: On January 1, 2009, Panda Company purchased

Q24: The purchase by a subsidiary of some