Essay

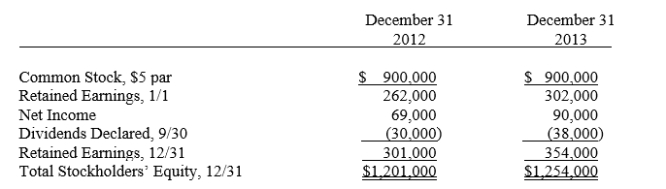

Partner Company acquired 85% of the common stock of Simplex Company in two separate cash transactions.The first purchase of 108,000 shares (60%) on January 1, 2012, cost $735,000.The second purchase, one year later, of 45,000 shares (25%) cost $330,000.Simplex Company's stockholders' equity was as follows:

On April 1, 2013, after a significant rise in the market price of Simplex Company's stock, Partner Company sold 32,400 of its Simplex Company shares for $390,000.Simplex Company notified Partner Company that its net income for the first three months was $22,000.The shares sold were identified as those obtained in the first purchase.Any difference between cost and book value relates to goodwill.Partner uses the partial equity method to account for its investment in Simplex Company.

Required:

A.Prepare the journal entries Partner Company will make on its books during 2012 and 2013 to account for its investment in Simplex Company.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31, 2013.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Pizza Company purchased Salt Company common stock

Q4: Poole made the following purchases of Smarte

Q7: Parr Company owned 24,000 of the 30,000

Q9: Pratt Company purchased 40,000 shares of Silas

Q10: P Corporation purchased an 80% interest in

Q11: Which one of the following statements regarding

Q11: P Company purchased 96,000 shares of the

Q15: The computation of noncontrolling interest in net

Q21: If a subsidiary issues new shares of

Q24: The purchase by a subsidiary of some