Multiple Choice

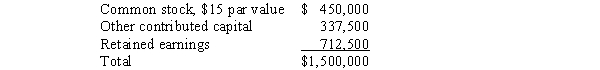

Parr Company owned 24,000 of the 30,000 outstanding common shares of Solomon Company on January 1, 2013.Parr's shares were purchased at book value when the fair values of Solomon's assets and liabilities were equal to their book values.The stockholders' equity of Solomon Company on January 1, 2013, consisted of the following:  Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2013.If Parr Company purchased all 7,500 shares, the book entry to record the purchase should increase the Investment in Solomon Company account by

Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2013.If Parr Company purchased all 7,500 shares, the book entry to record the purchase should increase the Investment in Solomon Company account by

A) $562,500.

B) $590,625.

C) $675,000.

D) $150,000.

E) Some other account.why now have 5 choices? most professors would prefer the consistency of 4 only - be consistent

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Pizza Company purchased Salt Company common stock

Q4: Poole made the following purchases of Smarte

Q6: Partner Company acquired 85% of the common

Q9: Pratt Company purchased 40,000 shares of Silas

Q10: P Corporation purchased an 80% interest in

Q11: Which one of the following statements regarding

Q11: P Company purchased 96,000 shares of the

Q12: On January 1 2013, Paulus Company purchased

Q15: The computation of noncontrolling interest in net

Q24: The purchase by a subsidiary of some