Multiple Choice

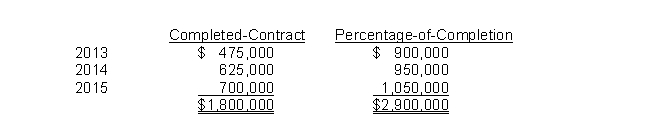

During 2015, a construction company changed from the completed-contract method to the percentage-of-completion method for accounting purposes but not for tax purposes. Gross profit figures under both methods for the past three years appear below:  Assuming an income tax rate of 40% for all years, the affect of this accounting change on prior periods should be reported by a credit of

Assuming an income tax rate of 40% for all years, the affect of this accounting change on prior periods should be reported by a credit of

A) $660,000 on the 2015 income statement.

B) $450,000 on the 2015 income statement.

C) $660,000 on the 2015 retained earnings statement.

D) $450,000 on the 2015 retained earnings statement.

Correct Answer:

Verified

Correct Answer:

Verified

Q60: Companies record corrections of errors from prior

Q61: Use the following information for questions 57

Q62: Which of the following is accounted for

Q63: On January 1, 2012, Knapp Corporation acquired

Q64: Mars, Inc. follows IFRS for its external

Q66: For counterbalancing errors, restatement of comparative financial

Q67: Show how the following independent errors will

Q68: Use the following information for questions 47

Q69: Use the following information for questions 66

Q70: If, at the end of a period,