Short Answer

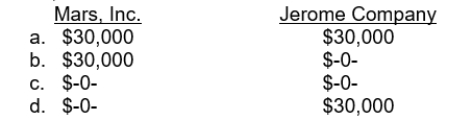

Mars, Inc. follows IFRS for its external financial reporting, while Jerome Company uses U.S. GAAP for its external financial reporting. During the year ended December 31, 2015, both companies changed from using the completed-contract method of revenue recognition for long-term construction contracts to the percentage-of-completion method. Both companies experienced an indirect effect, related to increased profit-sharing payments in 2015, of $30,000. As a result of this change, how much expense related to the profit-sharing payment must be recognized by each company on the income statement for the year ended December 31, 2015?

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Accounting changes are often made and the

Q60: Companies record corrections of errors from prior

Q61: Use the following information for questions 57

Q62: Which of the following is accounted for

Q63: On January 1, 2012, Knapp Corporation acquired

Q65: During 2015, a construction company changed from

Q66: For counterbalancing errors, restatement of comparative financial

Q67: Show how the following independent errors will

Q68: Use the following information for questions 47

Q69: Use the following information for questions 66