Multiple Choice

Use the following information for questions 57 through 59.

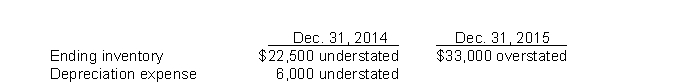

Langley Company's December 31 year-end financial statements contained the following errors:  An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

-What is the total effect of the errors on the balance of Langley's retained earnings at December 31, 2015?

A) Retained earnings understated by $30,000

B) Retained earnings understated by $13,500

C) Retained earnings understated by $7,500

D) Retained earnings overstated by $10,500

Correct Answer:

Verified

Correct Answer:

Verified

Q56: Companies must make correcting entries for noncounterbalancing

Q57: Retrospective application refers to the application of

Q58: Equipment was purchased at the beginning of

Q59: Accounting changes are often made and the

Q60: Companies record corrections of errors from prior

Q62: Which of the following is accounted for

Q63: On January 1, 2012, Knapp Corporation acquired

Q64: Mars, Inc. follows IFRS for its external

Q65: During 2015, a construction company changed from

Q66: For counterbalancing errors, restatement of comparative financial