Multiple Choice

Use the following information for questions 55 and 56.

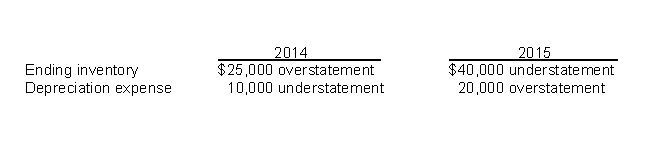

Armstrong Inc. is a calendar-year corporation. Its financial statements for the years ended 12/31/14 and 12/31/15 contained the following errors:

-Assume that no correcting entries were made at 12/31/14, or 12/31/15. Ignoring income taxes, by how much will retained earnings at 12/31/15 be overstated or understated?

A) $40,000 overstatement

B) $35,000 overstatement

C) $50,000 understatement

D) $15,000 understatement

Correct Answer:

Verified

Correct Answer:

Verified

Q67: Show how the following independent errors will

Q68: Use the following information for questions 47

Q69: Use the following information for questions 66

Q70: If, at the end of a period,

Q71: Ben, Inc. follows U.S. GAAP for its

Q73: The controller for Haley Corporation is concerned

Q74: Use the following information for questions 61

Q75: Accounting errors include changes in estimates that

Q76: Use the following information for questions 57

Q77: In 2015, Fischer Corporation changed its method