Essay

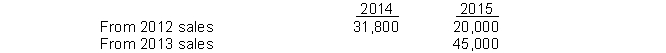

The controller for Haley Corporation is concerned about certain business transactions that the company experienced during 2015. The controller, after discussing these matters with various individuals, has come to you for advice. The transactions at issue are presented below."1. The company has decided to switch from the direct write-off method in accounting for bad debt expense to the percentage-of-sales approach. Assume that Haley Corporation has recognized bad debt expense as the receivables have actually become uncollectible in the following way:  The controller estimates that an additional $65,400 will be charged off in 2016: $11,400 applicable to 2014 sales and $54,000 to 2015 sales."2. Inventory has been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such on account. At December 31, 2015, inventory billed and in the hands of consignees amounted to $425,000. The percentage markup on selling price is 20%. Assume that consigned inventory is sold the following year. The company uses the perpetual inventory system."3. During the current year, the company sold $600,000 of goods on the installment basis. The cost of sales associated with these goods sold is $450,000. The company inadvertently handled these sales and related costs as part of the regular sales transactions. Cash of $172,000, including a down payment of $60,000, was collected on these installment sales during the current year. Due to questionable collectibility, the installment-sales method was considered appropriate.

The controller estimates that an additional $65,400 will be charged off in 2016: $11,400 applicable to 2014 sales and $54,000 to 2015 sales."2. Inventory has been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such on account. At December 31, 2015, inventory billed and in the hands of consignees amounted to $425,000. The percentage markup on selling price is 20%. Assume that consigned inventory is sold the following year. The company uses the perpetual inventory system."3. During the current year, the company sold $600,000 of goods on the installment basis. The cost of sales associated with these goods sold is $450,000. The company inadvertently handled these sales and related costs as part of the regular sales transactions. Cash of $172,000, including a down payment of $60,000, was collected on these installment sales during the current year. Due to questionable collectibility, the installment-sales method was considered appropriate.

Instructions

(a) Assume that Haley Corporation reported net income of $1,200,000 for 2015. Present a schedule showing the corrected net income after reviewing the above transactions.

(b) Prepare the journal entries necessary at December 31, 2015, assuming that the books have been closed."

Correct Answer:

Verified

Correct Answer:

Verified

Q68: Use the following information for questions 47

Q69: Use the following information for questions 66

Q70: If, at the end of a period,

Q71: Ben, Inc. follows U.S. GAAP for its

Q72: Use the following information for questions 55

Q74: Use the following information for questions 61

Q75: Accounting errors include changes in estimates that

Q76: Use the following information for questions 57

Q77: In 2015, Fischer Corporation changed its method

Q78: Black, Inc. is a calendar-year corporation whose