Essay

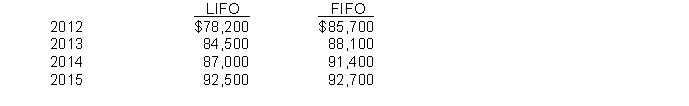

In 2015, Fischer Corporation changed its method of inventory pricing from LIFO to FIFO. Net income computed on a LIFO as compared to a FIFO basis for the four years involved is: (Ignore income taxes.)

Instructions

(a) Indicate the net income that would be shown on comparative financial statements issued at 12/31/15 for each of the four years, assuming that the company changed to the FIFO method in 2015.

(b) Assume that the company had switched from the average cost method to the FIFO method with net income on an average cost basis for the four years as follows: 2012, $80,400; 2013, $86,120; 2014, $90,300; and 2015, $93,600. Indicate the net income that would be shown on comparative financial statements issued at 12/31/15 for each of the four years under these conditions.

(c) Assuming that the company switched from the FIFO to the LIFO method, what would be the net income reported on comparative financial statements issued at 12/31/15 for 2012, 2013, and 2014?

Correct Answer:

Verified

(a) 2012, $85,700; 2013, $88,100; 2014, ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Use the following information for questions 55

Q73: The controller for Haley Corporation is concerned

Q74: Use the following information for questions 61

Q75: Accounting errors include changes in estimates that

Q76: Use the following information for questions 57

Q78: Black, Inc. is a calendar-year corporation whose

Q79: One of the disclosure requirements for a

Q80: For each of the following items, indicate

Q81: On January 1, 2010, Powell Company purchased

Q82: On January 1, 2012, Piper Co., purchased