Multiple Choice

Use the following information for questions 82 through 85.

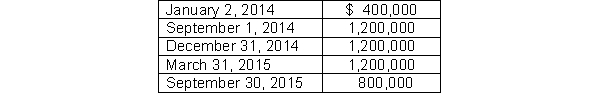

On January 2, 2014, Indian River Groves began construction of a new citrus processing plant. The automated plant was finished and ready for use on September 30, 2015. Expenditures for the construction were as follows:  Indian River Groves borrowed $2,200,000 on a construction loan at 12% interest on January 2, 2014. This loan was outstanding during the construction period. The company also had $8,000,000 in 9% bonds outstanding in 2014 and 2015.

Indian River Groves borrowed $2,200,000 on a construction loan at 12% interest on January 2, 2014. This loan was outstanding during the construction period. The company also had $8,000,000 in 9% bonds outstanding in 2014 and 2015.

-What were the weighted-average accumulated expenditures for 2014?

A) $1,066,667

B) $1,000,000

C) $800,000

D) $2,000,000

Correct Answer:

Verified

Correct Answer:

Verified

Q84: On August 1, 2014, Hayes Corporation purchased

Q85: Under IFRS, Sampson Company, who has a

Q86: Consider each of the items below. Place

Q87: What are the weighted-average accumulated expenditures?<br>A) $8,760,000<br>B)

Q88: An improvement made to a machine increased

Q90: Lewis Company traded machinery with a book

Q91: Assume the weighted-average accumulated expenditures for the

Q92: Storm Corporation purchased a new machine on

Q93: Nonmonetary exchange.<br>Hodge Co. exchanged Building 24 which

Q94: Capitalization of interest.<br>Early in 2014, Dobbs Corporation