Essay

Capitalization of interest.

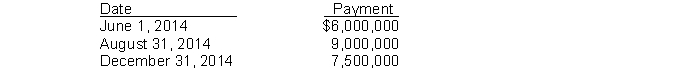

Early in 2014, Dobbs Corporation engaged Kiner, Inc. to design and construct a complete modernization of Dobbs's manufacturing facility. Construction was begun on June 1, 2014 and was completed on December 31, 2014. Dobbs made the following payments to Kiner, Inc. during 2014:  In order to help finance the construction, Dobbs issued the following during 2014:"

In order to help finance the construction, Dobbs issued the following during 2014:"

1. $5,000,000 of 10-year, 9% bonds payable, issued at par on May 31, 2014, with interest payable annually on May 31.

2. 1,000,000 shares of no-par common stock, issued at $10 per share on October 1, 2014.In addition to the 9% bonds payable, the only debt outstanding during 2014 was a $1,250,000, 12% note payable dated January 1, 2010 and due January 1, 2020, with interest payable annually on January 1.

Instructions

Compute the amounts of each of the following (show computations):"

1. Weighted-average accumulated expenditures qualifying for capitalization of interest cost.

2. Avoidable interest incurred during 2014.

3. Total amount of interest cost to be capitalized during 2014.

Correct Answer:

Verified

The interest cost to be capit...

The interest cost to be capit...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: Use the following information for questions 82

Q90: Lewis Company traded machinery with a book

Q91: Assume the weighted-average accumulated expenditures for the

Q92: Storm Corporation purchased a new machine on

Q93: Nonmonetary exchange.<br>Hodge Co. exchanged Building 24 which

Q95: Under IFRS, assets that qualify for interest

Q96: Messersmith Company is constructing a building. Construction

Q97: What amount should Glen Inc. record for

Q98: Use the following information to answer questions

Q99: Which of the following assets do not