Multiple Choice

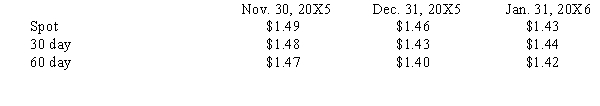

Larson, Inc. sold merchandise for 600,000 FC to a foreign vendor on November 30, 20X5. Payment in foreign currency is due January 31, 20X6. On the same day, Larson signed an agreement with a foreign exchange broker to sell 600,000 FC on January 31, 20X6. Exchange rates to purchase 1 FC are as follows:  What will be the recorded amount of the Forward Contract on November 30, 20X5?

What will be the recorded amount of the Forward Contract on November 30, 20X5?

A) $894,000

B) $888,000

C) $882,000

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The purpose of a hedge on an

Q8: In a hedge of a forecasted transaction,

Q23: A transaction involving foreign currency will most

Q26: A bank dealing in foreign currency tells

Q57: On 6/1/X2, an American firm sold inventory

Q58: Wolters Corporation is a U.S. corporation that

Q60: Zerlie's Imports purchased automotive parts from a

Q64: Bulldog Enterprise, a U.S. firm, agreed on

Q65: On 6/1/X2, an American firm purchased inventory

Q66: Which is true of foreign currency forward