Essay

Wolters Corporation is a U.S. corporation that purchased 50,000 chocolate bars from a foreign manufacturer on March 1, 20X9 for 80,000 foreign currency units, to be paid on April 30, 20X9. On March 1, 20X9 Wolters also entered into a forward contract to purchase 80,000 foreign currency units on April 30, 20X9. Wolters has a March 31 year end.

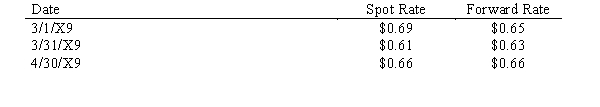

Exchange rates are as follows:

Required:

Prepare the journal entries to record the transactions through April 30, 20X9. March 31 is the fiscal period end. Ignore the split between spot gain/loss and time value.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The purpose of a hedge on an

Q8: In a hedge of a forecasted transaction,

Q23: A transaction involving foreign currency will most

Q26: A bank dealing in foreign currency tells

Q53: On 6/1/X2, an American firm purchased inventory

Q54: Larson, Inc. sold merchandise for 600,000 FC

Q55: Lion Corporation, a U.S. firm, entered into

Q57: On 6/1/X2, an American firm sold inventory

Q60: Zerlie's Imports purchased automotive parts from a

Q61: Larson, Inc. sold merchandise for 600,000 FC