Multiple Choice

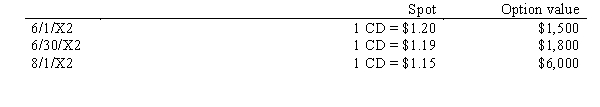

On 6/1/X2, an American firm sold inventory costing 100,000 Euro from a Dutch firm with payment to be received on 8/1/X2. Also on 6/1/X2, the American firm acquired an option for $1,500 to sell 100,000 Euro on 8/1/X2. The strike price for the option was $1.21. The exchange rates were as follows:  The American firm's fiscal year end is June 30, 20X2. What is the net gain or loss recognized in the financial statements for the year ended June 30, 20X2?

The American firm's fiscal year end is June 30, 20X2. What is the net gain or loss recognized in the financial statements for the year ended June 30, 20X2?

A) $700 loss

B) $1,000 loss

C) $6,000 loss

D) $4,300 loss

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The purpose of a hedge on an

Q8: In a hedge of a forecasted transaction,

Q23: A transaction involving foreign currency will most

Q36: To qualify for fair value hedge accounting,

Q53: On 6/1/X2, an American firm purchased inventory

Q54: Larson, Inc. sold merchandise for 600,000 FC

Q55: Lion Corporation, a U.S. firm, entered into

Q58: Wolters Corporation is a U.S. corporation that

Q60: Zerlie's Imports purchased automotive parts from a

Q61: Larson, Inc. sold merchandise for 600,000 FC