Multiple Choice

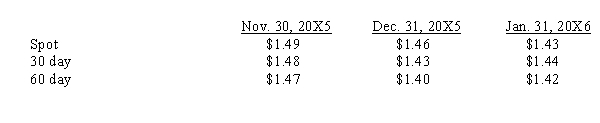

Larson, Inc. sold merchandise for 600,000 FC to a foreign vendor on November 30, 20X5. Payment in foreign currency is due January 31, 20X6. On the same day, Larson signed an agreement with a foreign exchange broker to sell 600,000 FC on January 31, 20X6. The discount rate is 8% and exchange rates to purchase 1 FC are as follows:  What is the net amount of the gains or losses recognized in the financial statements for the year ended December 31, 20x5?

What is the net amount of the gains or losses recognized in the financial statements for the year ended December 31, 20x5?

A) $5,840 gain

B) $6,000 loss

C) $18,000 loss

D) $12,000 gain

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The purpose of a hedge on an

Q8: In a hedge of a forecasted transaction,

Q36: To qualify for fair value hedge accounting,

Q47: The time value of an option is

Q49: A U.S. manufacturer has sold goods to

Q51: Pile, Inc. purchased merchandise for 500,000 FC

Q53: On 6/1/X2, an American firm purchased inventory

Q55: Lion Corporation, a U.S. firm, entered into

Q57: On 6/1/X2, an American firm sold inventory

Q58: Wolters Corporation is a U.S. corporation that