Multiple Choice

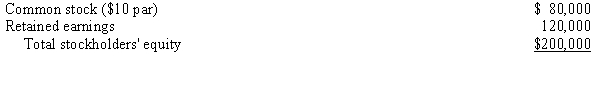

Partridge purchased a 60% interest in Sparrow on January 1, 20X1, for $240,000. At the time of the purchase, Sparrow had the following stockholders' equity:  Any excess is attributable to equipment with a 10-year life. On January 1, 20X6, the retained earnings of Sparrow was $175,000. During the first 6 months of 20X6, $25,000 was earned by Sparrow. The entire investment was sold for $300,000 on July 1, 20X6. The gain (loss) was ____.

Any excess is attributable to equipment with a 10-year life. On January 1, 20X6, the retained earnings of Sparrow was $175,000. During the first 6 months of 20X6, $25,000 was earned by Sparrow. The entire investment was sold for $300,000 on July 1, 20X6. The gain (loss) was ____.

A) $87,000

B) $78,000

C) $12,000

D) $60,000

Correct Answer:

Verified

Correct Answer:

Verified

Q15: On January 1, 20X1, Patrick Company purchased

Q17: On January 1, 20X1, Parent Company purchased

Q19: Pepin Company owns 75% of Savin Corp.Savin's

Q20: On January 1, 20X1, Patrick Company purchased

Q21: Company P Industries purchased a 70% interest

Q22: On January 1, 20X1, Company P purchased

Q23: Pine Company purchased a 60% interest in

Q24: Pine Company purchased a 60% interest in

Q25: A parent company owns a 90% interest

Q35: Which of the following statements is incorrect