Essay

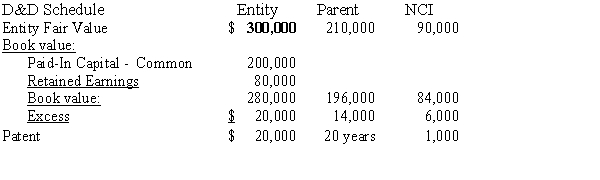

Company P Industries purchased a 70% interest in Company S on January 1, 20X1, and prepared the following determination and distribution of excess schedule:

Since the purchase, there have been the following intercompany transactions:

(1)On January 1, 20X2, Company P sold a piece of equipment with a net book value of $40,000 to Company S for $50,000. The equipment had a five-year remaining life.

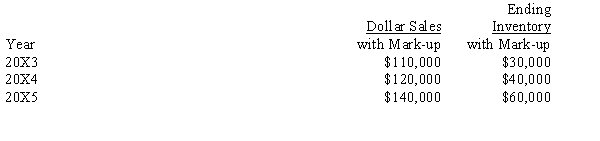

(2)Each year, starting in 20X3, Company S has sold merchandise for resale to Company P at a gross profit of 20%. A summary of transactions shows the following:

(3)On January 1, 20X5, Company P purchased Company S's 8%, $100,000 face value bonds for $98,000, which were issued at par value. The bonds have five years to maturity.

Required:

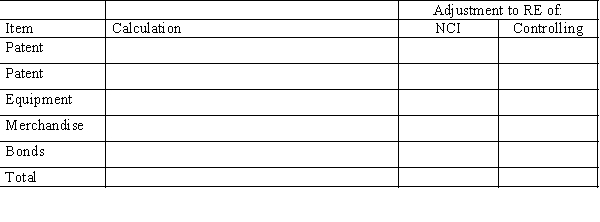

Complete the following schedule to adjust the retained earnings of the noncontrolling and controlling interest on the December 31, 20X5, worksheet for a consolidated balance sheet only. Company P uses the simple equity method to account for its investment.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: On January 1, 20X1, Parent Company purchased

Q19: Partridge purchased a 60% interest in Sparrow

Q19: Pepin Company owns 75% of Savin Corp.Savin's

Q20: On January 1, 20X1, Patrick Company purchased

Q22: On January 1, 20X1, Company P purchased

Q23: Pine Company purchased a 60% interest in

Q24: Pine Company purchased a 60% interest in

Q25: A parent company owns a 90% interest

Q25: Company P owns an 90% interest in

Q26: Page Company purchased an 80% interest in