Essay

On January 1, 20X1, Patrick Company purchased 60% of the common stock of Solomon Company for $180,000. On this date, Solomon had common stock, other paid-in capital, and retained earnings of $20,000, $60,000, and $120,000 respectively.

On January 1, 20X1, the only tangible asset of Solomon that was undervalued was land, which was worth $15,000 more than book value.

On January 1, 20X2, Patrick Company purchased an additional 30% of the common stock of Solomon Company for $140,000.

Net income and dividends for 2 years for Solomon Company were:

In the last quarter of 20X2, Solomon sold $80,000 of goods to Patrick, at a gross profit rate of 30%. On December 31, 20X2, $20,000 of these goods are in Patrick's ending inventory. In both 20X1 and 20X2, Patrick has accounted for its investment in Solomon using the simple equity method.

Required:

a.Using the information from the scenario or on the separate worksheet, prepare necessary determination and distribution of excess schedules for the two purchases.

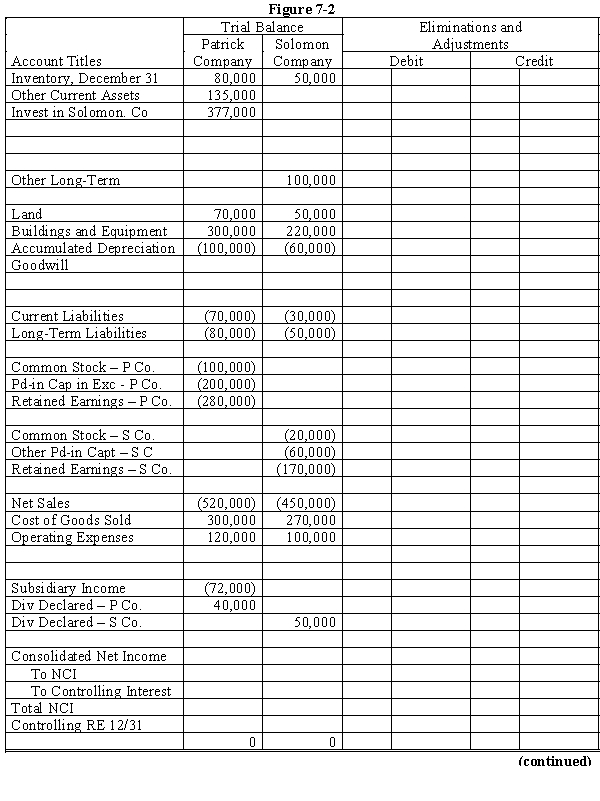

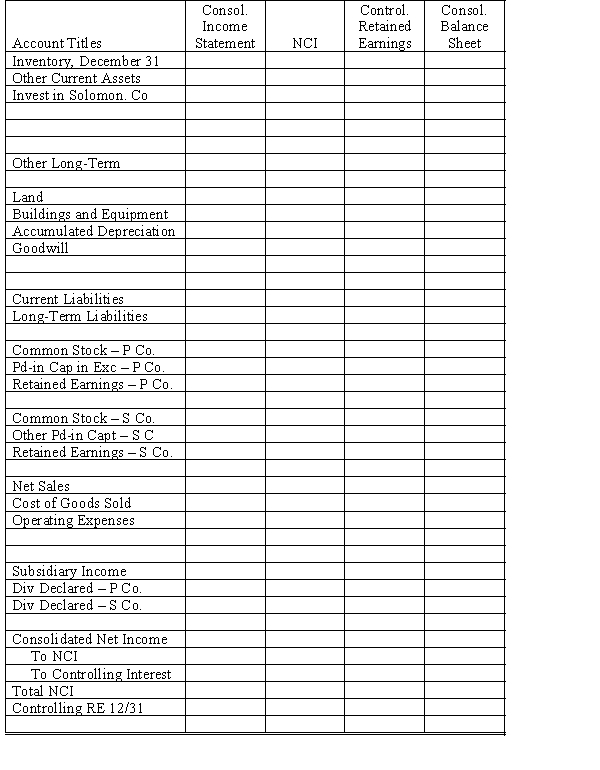

b.Complete the Figure 7-2 worksheet for consolidated financial statements for 20X2.

Correct Answer:

Verified

D&D schedule for first acquisition:

An...

An...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: On January 1, 20X1, Patrick Company purchased

Q17: On January 1, 20X1, Parent Company purchased

Q19: Partridge purchased a 60% interest in Sparrow

Q19: Pepin Company owns 75% of Savin Corp.Savin's

Q21: Company P Industries purchased a 70% interest

Q22: On January 1, 20X1, Company P purchased

Q23: Pine Company purchased a 60% interest in

Q24: Pine Company purchased a 60% interest in

Q25: A parent company owns a 90% interest

Q25: Company P owns an 90% interest in