Essay

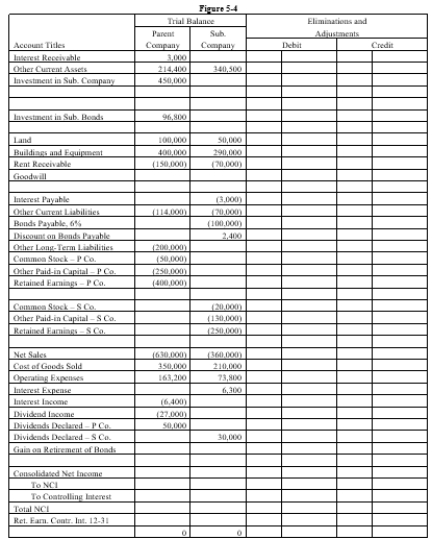

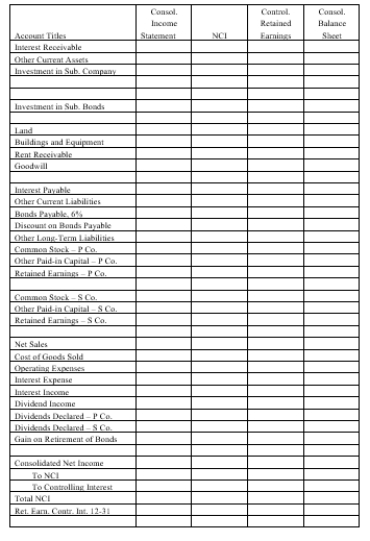

On January 1, 20X4, Parent Company purchased 90% of the common stock of Subsidiary Company for $450,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $20,000, $130,000, and $200,000, respectively. Any excess of cost over book value is due to goodwill. Parent accounts for the Investment in Subsidiary using the cost method.

On January 1, 20X4, Subsidiary sold $100,000 par value of 6%, ten-year bonds for $97,000. The bonds pay interest semi-annually on January 1 and July 1 of each year.

On January 1, 20X5, Parent repurchased all of Subsidiary's bonds for $96,400. The bonds are still held on December 31, 20X5.

Both companies have correctly recorded all entries relative to bonds and interest, using straight-line amortization for premium or discount.

Required:

Complete the Figure 5-4 worksheet for consolidated financial statements for the year ended of December 31, 20X5. Round all computations to the nearest dollar.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: On January 1, 20X1, Parent Company acquired

Q5: Park owns an 80% interest in the

Q7: Company P owns 80% of Company S.

Q8: Soap Company issued $200,000 of 8%, 5-year

Q11: Smart Corporation is a 90%-owned subsidiary of

Q16: The usual impetus for transactions that create

Q33: Company S is a 100%-owned subsidiary of

Q40: A subsidiary has outstanding $100,000 of 8%

Q48: Company S is a 100%-owned subsidiary of

Q50: Phil Company leased a machine to its