Essay

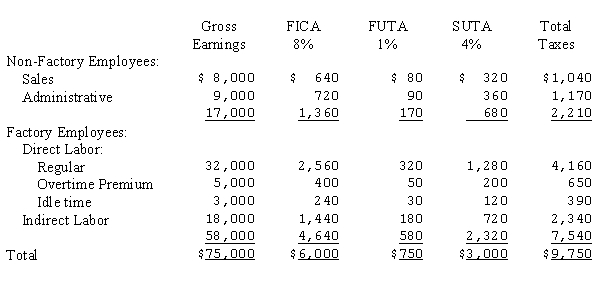

The Wagner Company's Schedule of Earnings and Payroll Taxes for May is summarized as follows:  (a) Prepare the journal entry to distribute payroll under each of the following scenarios:

(a) Prepare the journal entry to distribute payroll under each of the following scenarios:

(1) Overtime resulted from priority scheduling of Job 3bX for which the company received a rush order.

(2) Overtime resulted from random scheduling of jobs.

(b) Prepare the journal entry to record and distribute the employer's payroll taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Joel Williams works at Allentown Company where

Q4: John Elton, who is classified as direct

Q5: Under a modified wage plan, Jim Phillips

Q6: The payroll summary for EVB Inc. for

Q7: An employee regularly earns $12 per hour

Q10: Under a modified wage plan, an employee

Q11: Harmony Company has accrued payroll costs of

Q16: A factory worker earns $500 per week

Q18: Jay Vato works at Batwing Industries from

Q20: If the amount of overtime premium is