Essay

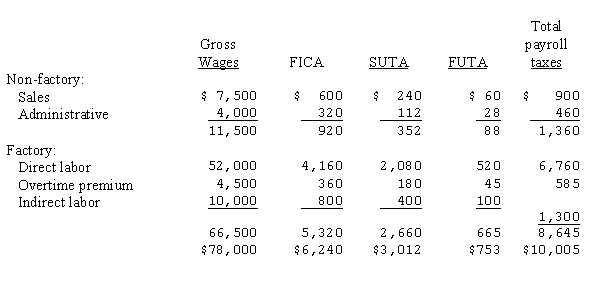

Tacy Company's Schedule of Earnings and Payroll taxes for the period ended March 28 - 31 to be paid April 5 follow:  Prepare the journal entries to:

Prepare the journal entries to:

(a) Accrue the payroll in the appropriate period

(b) Distribute the accrued payroll in the appropriate period

(c) Recognize related accrued employer's payroll taxes in the appropriate period assuming payroll taxes are spread over all jobs produced.

Correct Answer:

Verified

The following journa...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: The entry made in November to reverse

Q41: Features of a 401(k)plan include all of

Q41: The following payroll summary is prepared for

Q42: John Elton, who is classified as direct

Q43: Management of the Von Machine Company requests

Q44: Daktari Enterprises' Schedule of Earnings and Payroll

Q46: Becky Graham earns $15 per hour for

Q47: Ken Astor is a factory worker at

Q48: David Andrews works at the Neal Company

Q50: An analysis of total labor costs into