Multiple Choice

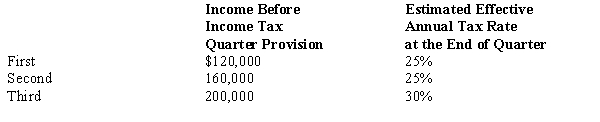

Bjork, a calendar year company, has the following income before income tax provision and estimated effective annual income tax rates for the first three quarters of 2017:  Bjork's income tax provision in its interim income statement for the third quarter should be

Bjork's income tax provision in its interim income statement for the third quarter should be

A) $74,000.

B) $60,000.

C) $50,000.

D) $144,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following is NOT required

Q3: For interim financial reporting, the effective tax

Q4: Gains and losses that arise in an

Q5: A component of an enterprise that may

Q6: An enterprise determines that it must report

Q7: Blink Company, which uses the FIFO inventory

Q8: The computation of a company's third quarter

Q9: Current authoritative pronouncements require the disclosure of

Q10: In SFAS No. 131, the FASB requires

Q11: If annual major repairs made in the