Multiple Choice

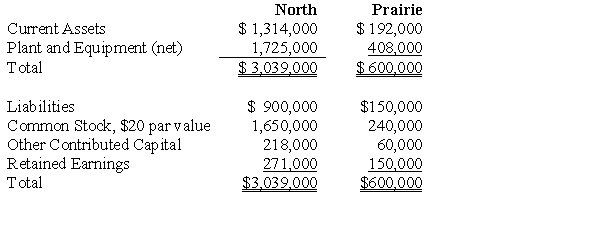

North Company issued 24,000 shares of its $20 par value common stock for the net assets of Prairie Company in business combination under which Prairie Company will be merged into North Company. On the date of the combination, North Company common stock had a fair value of $30 per share. Balance sheets for North Company and Prairie Company immediately prior to the combination were as follows:  If the business combination is treated as an acquisition and Prairie Company's net assets have a fair value of $686,400, North Company's balance sheet immediately after the combination will include goodwill of:

If the business combination is treated as an acquisition and Prairie Company's net assets have a fair value of $686,400, North Company's balance sheet immediately after the combination will include goodwill of:

A) $30,600.

B) $38,400.

C) $33,600.

D) $56,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Balance sheet information for Hope Corporation at

Q18: SFAS No. 142 requires that goodwill impairment

Q19: When the acquisition price of an acquired

Q20: Edina Company acquired the assets (except cash)

Q21: Under SFAS 141R, what value of the

Q23: P Company acquires all of the voting

Q24: In a business combination, which of the

Q25: If an impairment loss is recorded on

Q26: The fair value of assets and liabilities

Q27: In a period in which an impairment