Essay

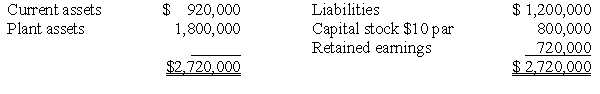

Balance sheet information for Hope Corporation at January 1, 2016, is summarized as follows:  Hope's assets and liabilities are fairly valued except for plant assets that are undervalued by $200,000. On January 2, 2016, Robin Corporation issues 80,000 shares of its $10 par value common stock for all of Hope's net assets and Hope is dissolved. Market quotations for the two stocks on this date are:

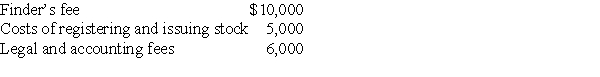

Hope's assets and liabilities are fairly valued except for plant assets that are undervalued by $200,000. On January 2, 2016, Robin Corporation issues 80,000 shares of its $10 par value common stock for all of Hope's net assets and Hope is dissolved. Market quotations for the two stocks on this date are:  Robin pays the following fees and costs in connection with the combination:

Robin pays the following fees and costs in connection with the combination:  Required:

Required:

A. Calculate Robin's investment cost of Hope Corporation.

B. Calculate any goodwill from the business combination.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: SFAS 141R requires that all business combinations

Q13: Under the acquisition method, if the fair

Q14: P Corporation issued 10,000 shares of common

Q15: Under SFAS 141R:<br>A) both direct and indirect

Q16: In a leveraged buyout, the portion of

Q18: SFAS No. 142 requires that goodwill impairment

Q19: When the acquisition price of an acquired

Q20: Edina Company acquired the assets (except cash)

Q21: Under SFAS 141R, what value of the

Q22: North Company issued 24,000 shares of its