Essay

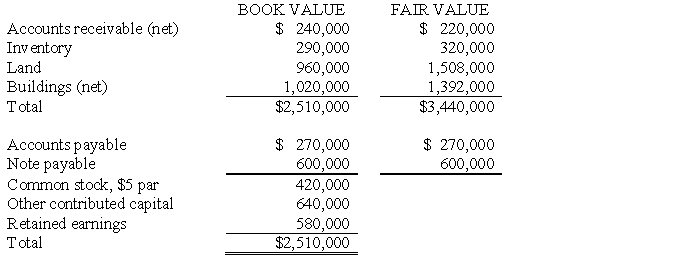

Edina Company acquired the assets (except cash) and assumed the liabilities of Burns Company on January 1, 2016, paying $2,600,000 cash. Immediately prior to the acquisition, Burns Company's balance sheet was as follows:  Edina Company agreed to pay Burns Company's former stockholders $200,000 cash in 2017 if post- combination earnings of the combined company reached $1,000,000 during 2016.

Edina Company agreed to pay Burns Company's former stockholders $200,000 cash in 2017 if post- combination earnings of the combined company reached $1,000,000 during 2016.

Required:

A. Prepare the journal entry necessary for Edina Company to record the acquisition on January 1, 2016. It is expected that the earnings target is likely to be met.

B. Prepare the journal entry necessary for Edina Company in 2017 assuming the earnings contingency was not met.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Under SFAS 141R:<br>A) both direct and indirect

Q16: In a leveraged buyout, the portion of

Q17: Balance sheet information for Hope Corporation at

Q18: SFAS No. 142 requires that goodwill impairment

Q19: When the acquisition price of an acquired

Q21: Under SFAS 141R, what value of the

Q22: North Company issued 24,000 shares of its

Q23: P Company acquires all of the voting

Q24: In a business combination, which of the

Q25: If an impairment loss is recorded on