Multiple Choice

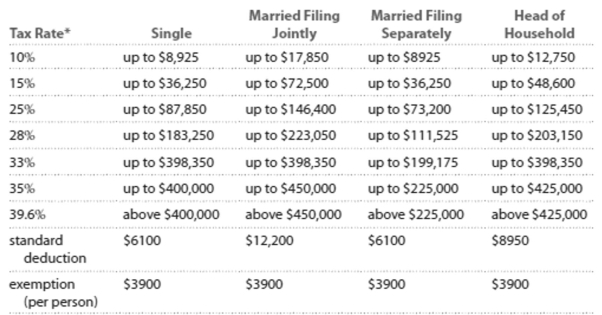

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to \$36,250.

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Kyle is single and earned wages of $34,036. He received $362 in interest from a savings account. He contributed $549 to a tax-deferred retirement plan. He had $405 in itemized deductions from

Charitable contributions. Calculate his adjusted gross income.

A) $34,947

B) $34,542

C) $33,849

D) $33,444

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Solve the problem. Refer to the table

Q32: Solve the problem. Refer to the

Q33: Solve the equation for the unknown

Q34: Determine whether the spending pattern described is

Q35: Decide whether the statement makes sense. Explain

Q37: Solve the problem.<br>-Calculate the annual interest for

Q38: Solve the problem.<br>- <span class="ql-formula" data-value="\$

Q39: Provide an appropriate response.<br>-A _ gives you

Q40: Solve the problem. Refer to the table

Q41: Provide an appropriate response.<br>-_ is interest paid