Multiple Choice

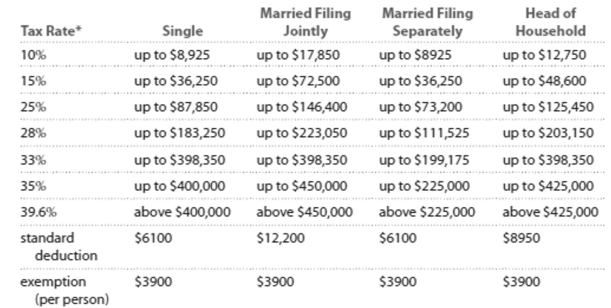

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Your deductible expenditures $4146 for contributions to charity and $635 for state income taxes. Your filing status entitles you to a standard deduction of $6100. Should you itemize your

Deductions rather than claiming the standard deduction? If so, what is the difference?

A) No, you are better off with the standard deduction.

B) Yes, $4781

C) Yes, $2589

D) Yes, $1319

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Use the given stock table to answer

Q28: Use the compound interest formula to determine

Q29: Solve the problem. Refer to the

Q30: You need a loan of $100,000

Q31: Solve the problem. Refer to the table

Q33: Solve the equation for the unknown

Q34: Determine whether the spending pattern described is

Q35: Decide whether the statement makes sense. Explain

Q36: Solve the problem. Refer to the

Q37: Solve the problem.<br>-Calculate the annual interest for