Multiple Choice

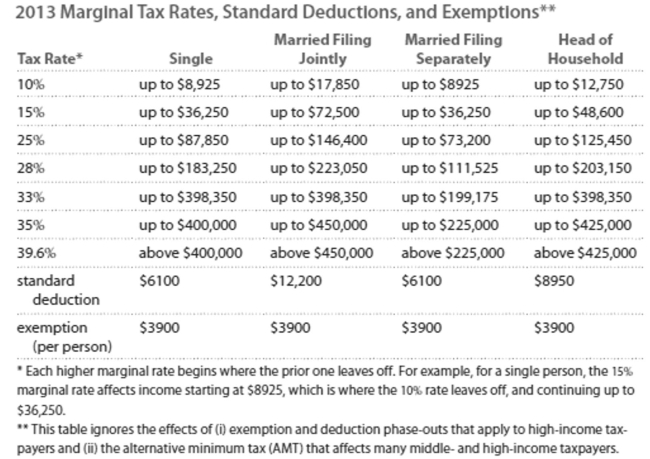

Solve the problem. Refer to the table if necessary.

-Kelsey earned $65,208 in wages. Conner earned $65,208, all in dividends and long-term capital gains. Calculate the overall tax rate for each, including both FICA and income taxes. Assume they

Are both single and take the standard deduction. Note that long-term capital gains and dividends

Are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax

Brackets.

A) Kelsey: 0.0%

B) Kelsey: 22.6%

C) Kelsey: 21.4%

D) Kelsey: 14.9% Conner: 7.3% Conner: 4.4% Conner: 12.0% Conner: 4.4%

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Write the word or phrase that best

Q27: Use the given stock table to answer

Q28: Use the compound interest formula to determine

Q29: Solve the problem. Refer to the

Q30: You need a loan of $100,000

Q32: Solve the problem. Refer to the

Q33: Solve the equation for the unknown

Q34: Determine whether the spending pattern described is

Q35: Decide whether the statement makes sense. Explain

Q36: Solve the problem. Refer to the