Short Answer

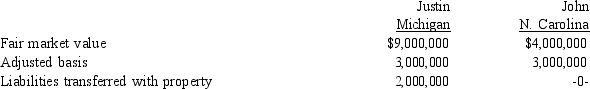

Justin trades an office building located in Michigan to John for an apartment complex located in North Carolina. Details of the two properties:

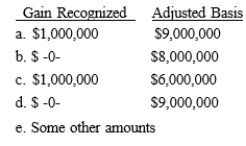

In addition, John pays Justin $3,000,000 cash as part of this transaction. What is the gain loss) recognized by John in this transaction and what is his basis in the Michigan property?

In addition, John pays Justin $3,000,000 cash as part of this transaction. What is the gain loss) recognized by John in this transaction and what is his basis in the Michigan property?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following exchanges of property

Q9: Matthew exchanges an investment apartment building for

Q9: In general, qualified replacement property for an

Q11: A flood destroys Owen's building that cost

Q16: Drake and Cynthia sell their home for

Q27: No taxable gain or loss is recognized

Q54: The deferral of a gain realized on

Q62: Belinda exchanges investment real estate with Russell.

Q81: Dominic and Lois sell their home for

Q109: The holding period of an asset received