Short Answer

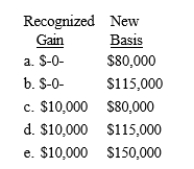

A flood destroys Owen's building that cost $100,000 in 2007, which has an adjusted basis of $80,000. Owen's insurance company reimburses him $125,000 for his loss. Owen promptly reconstructs the building for $115,000. What is the minimum amount of gain that Owen must recognize and his basis in the new building?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following exchanges of property

Q9: Matthew exchanges an investment apartment building for

Q9: In general, qualified replacement property for an

Q12: Justin trades an office building located in

Q16: Drake and Cynthia sell their home for

Q27: No taxable gain or loss is recognized

Q32: Which of the following qualifies as a

Q54: The deferral of a gain realized on

Q62: Belinda exchanges investment real estate with Russell.

Q109: The holding period of an asset received