Short Answer

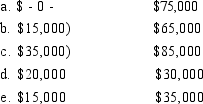

Matthew exchanges an investment apartment building for a parcel of land. The apartment building has a fair market value of $80,000 and an adjusted basis of $95,000. The land's value is $60,000. Matthew receives $20,000 cash in the exchange. What is Matthew's recognized gain or loss) on the exchange and his basis in the land? Gain Loss) Recognized Basis

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following exchanges of property

Q4: Donald and Candice sell their home for

Q11: A flood destroys Owen's building that cost

Q12: Justin trades an office building located in

Q27: No taxable gain or loss is recognized

Q32: Which of the following qualifies as a

Q54: The deferral of a gain realized on

Q62: Belinda exchanges investment real estate with Russell.

Q109: The holding period of an asset received

Q116: Mavis is a schoolteacher with an annual