Short Answer

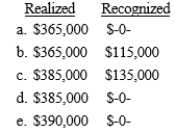

Tony and Faith sell their home for $495,000, incurring selling expenses of $25,000. They purchased the residence for $85,000 and made capital improvements totaling $20,000 during the 20 years they lived there. What is their realized gain and recognized gain on the sale?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following exchanges of property

Q4: Donald and Candice sell their home for

Q9: Matthew exchanges an investment apartment building for

Q11: A flood destroys Owen's building that cost

Q32: Which of the following qualifies as a

Q51: The earliest date that condemned property can

Q54: The deferral of a gain realized on

Q96: If related parties complete a qualified like-kind

Q109: The holding period of an asset received

Q116: Mavis is a schoolteacher with an annual