Essay

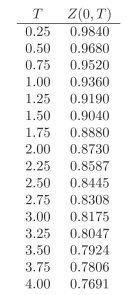

Use the following discount factors when needed.

-Calculate the convexity of the following portfolio:

i. 4 units of a 1.5-year ?xed rate bond paying 4% quarterly.

ii. 5 units of a 1.5-year ?xed rate bond paying 5% semiannually.

iii. 10 units of a 1.5-year zero coupon bond.

iv. 3 units of a 1.5-year ?oating rate bond with no spread paid semian- nually.

Correct Answer:

Verified

Annualized expected ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Suppose you hold a bond and interest

Q9: Use the following discount factors when needed.

Q10: Compute the Term Spread and the Butterfly

Q11: Use the following discount factors when needed.

Q12: Use the following discount factors when needed.

Q14: You currently hold a 7-year fixed rate

Q15: Compute the Term Spread and the Butterfly

Q16: You currently hold a 2-year fixed rate

Q17: How many securities do you need to

Q18: Use the following discount factors when needed.