Essay

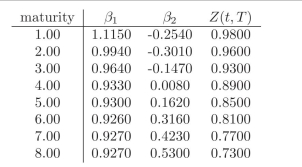

You currently hold a 7-year ?xed rate bond paying 5% annually. You would like to hedge against changes in the level and the slope of the yield curve and you plan to use a 1-year zero coupon bond and a 7-year zero coupon bond. Use the following table to compute the adequate positions in the hedging instruments.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: What is the advantage of a factor

Q3: Compute the Term Spread and the Butterfly

Q4: Use the following discount factors when needed.

Q5: Suppose you hold a bond and interest

Q6: If you need three securities to hedge

Q7: Compute the Term Spread and the Butter?y

Q8: Suppose you hold a bond and interest

Q9: Use the following discount factors when needed.

Q10: Compute the Term Spread and the Butterfly

Q11: Use the following discount factors when needed.