Multiple Choice

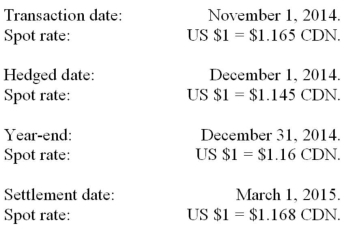

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  Assuming that the accounts receivable balance was not adjusted on December 1, 2014, what adjustment (if any) would be required to RXN's year-end accounts receivable balance?

Assuming that the accounts receivable balance was not adjusted on December 1, 2014, what adjustment (if any) would be required to RXN's year-end accounts receivable balance?

A) A $3,000 decrease.

B) A $1,500 decrease.

C) No adjustment is required.

D) A $3,000 increase.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: On July 1, 2012, CDN purchased inventory

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" GWN

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) A $15

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Prepare

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" On September 1,

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) The placement

Q24: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) A $15

Q25: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q26: Canada Corp. sells raw lumber to a

Q27: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $805 CDN.