Essay

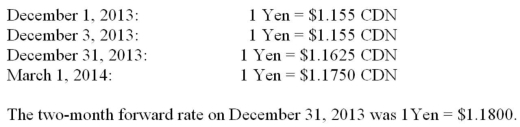

Canada Corp. sells raw lumber to a number of countries around the world. On December 1, 2013 the company shipped some lumber to a client in Japan. The selling price was established at 500,000 Yen with payment to be received on March 1, 2014. On December 3, 2013 the company entered into a hedge with a Canadian Bank at the 90 day forward rate of 1Yen = $1.185CDN. The forward contract was designated as a fair value hedge of the receivable from the Japanese customer. Canada Corp received the payment from its Japanese client on March 1, 2014. Canada Corp's year end is on December 31. Selected spot rates were as follows:  Prepare the journal entries to record the receipt of the 500,000 Yen on March 1, 2014, assuming that Canada Corp did not enter into a hedge transaction in December 2013.

Prepare the journal entries to record the receipt of the 500,000 Yen on March 1, 2014, assuming that Canada Corp did not enter into a hedge transaction in December 2013.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" On September 1,

Q22: RXN's year-end is on December 31. On

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) The placement

Q24: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) A $15

Q25: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q27: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $805 CDN.

Q28: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q29: RXN's year-end is on December 31. On

Q30: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $450 decrease.

Q31: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" At