Essay

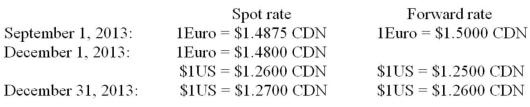

On September 1, 2013, Compucat purchased components from its German supplier for 100,000 Euros. On that date AMC entered into a forward contract for 100,000 Euros at the 60 day forward rate of 1Euro = $1.50CDN. The forward contract was designated as a fair value hedge of the amount payable to the German supplier. Compucat settled with the bank and paid its supplier in full on December 1, 2013. On December 1, 2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US. The invoice required that Compucat receive its payment in full by January 31, 2013. On the date of the sale, the company entered into a forward contract for $250,000US at the two-month forward rate of $1US = $1.25CDN. This forward contract was designated to be a fair value hedge of the amount due from the American customer. The dates and exchange rates relevant to these transactions are shown below.

On September 1, 2013, Compucat purchased components from its German supplier for 100,000 Euros. On that date AMC entered into a forward contract for 100,000 Euros at the 60 day forward rate of 1Euro = $1.50CDN. The forward contract was designated as a fair value hedge of the amount payable to the German supplier. Compucat settled with the bank and paid its supplier in full on December 1, 2013. On December 1, 2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US. The invoice required that Compucat receive its payment in full by January 31, 2013. On the date of the sale, the company entered into a forward contract for $250,000US at the two-month forward rate of $1US = $1.25CDN. This forward contract was designated to be a fair value hedge of the amount due from the American customer. The dates and exchange rates relevant to these transactions are shown below.  Prepare the December 31, 2013 Balance Sheet Presentation of the Receivable from the American client and the accounts associated with the hedge.

Prepare the December 31, 2013 Balance Sheet Presentation of the Receivable from the American client and the accounts associated with the hedge.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" What

Q17: On July 1, 2012, CDN purchased inventory

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" GWN

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) A $15

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Prepare

Q22: RXN's year-end is on December 31. On

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) The placement

Q24: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) A $15

Q25: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q26: Canada Corp. sells raw lumber to a