Short Answer

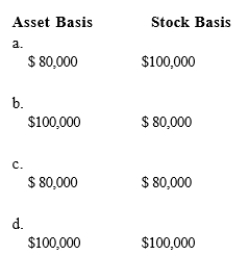

Chen contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a C corporation and the transaction qualifies under § 351, the corporation's basis for the property and the shareholder's basis for the stock are:

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Match the following statements.<br>-Sale of the corporate

Q12: Each of the following can pass profits

Q44: Melanie and Sonny form Bird Enterprises. Sonny

Q45: S corporation status always avoids double taxation.

Q60: Match the following statements.<br>-S corporations<br>A)Usually subject to

Q76: Ruchi contributes property with an adjusted basis

Q80: Match the following attributes with the different

Q85: If lease rental payments to a noncorporate

Q92: All of the shareholders of an S

Q105: Match the following statements.<br>-Sale of an ownership