Multiple Choice

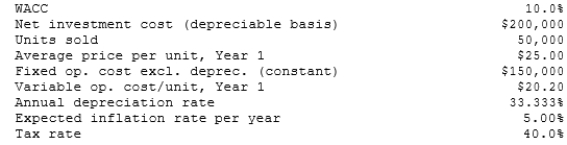

Thomson Media is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, some new working capital would be required, but it would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

A) $20,762

B) $21,854

C) $23,005

D) $24,155

E) $25,363

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Langston Labs has an overall (composite) WACC

Q17: Which of the following factors should be

Q18: Which of the following <u>should be considered</u>

Q19: When evaluating a new project, firms should

Q22: Your company, CSUS Inc., is considering a

Q25: Poulsen Industries is analyzing an average-risk project,

Q42: Suppose Walker Publishing Company is considering bringing

Q53: The change in net working capital associated

Q67: A firm that bases its capital budgeting

Q68: Estimating project cash flows is generally the