Multiple Choice

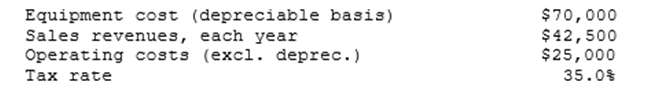

Your company, CSUS Inc., is considering a new project whose data are Shown below. The required equipment has a 3-year tax life, and the accelerated rates for such property are 33%, 45%, 15%, and 7% for Years

1 through 4. Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life. What is the project's Year 4 cash flow?

A) $11,814

B) $12,436

C) $13,090

D) $13,745

E) $14,432

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Which of the following factors should be

Q18: Which of the following <u>should be considered</u>

Q19: When evaluating a new project, firms should

Q21: Thomson Media is considering some new equipment

Q25: Poulsen Industries is analyzing an average-risk project,

Q29: Opportunity costs include those cash inflows that

Q42: Suppose Walker Publishing Company is considering bringing

Q53: The change in net working capital associated

Q67: A firm that bases its capital budgeting

Q68: Estimating project cash flows is generally the