Multiple Choice

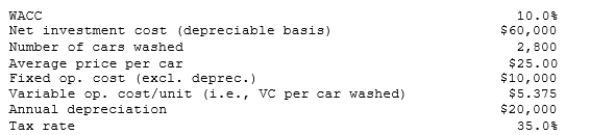

Poulsen Industries is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight- line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate, but the CFO thinks an adjustment is required. What is the difference in the expected NPV if the inflation adjustment is made vs. if it is not made?

A) $13,286

B) $13,985

C) $14,721

D) $15,457

E) $16,230

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The primary advantage to using accelerated rather

Q21: Thomson Media is considering some new equipment

Q22: Your company, CSUS Inc., is considering a

Q29: Opportunity costs include those cash inflows that

Q29: Which one of the following would <u>NOT</u>

Q30: We can identify the cash costs and

Q42: Suppose Walker Publishing Company is considering bringing

Q53: The change in net working capital associated

Q67: A firm that bases its capital budgeting

Q68: Estimating project cash flows is generally the