Multiple Choice

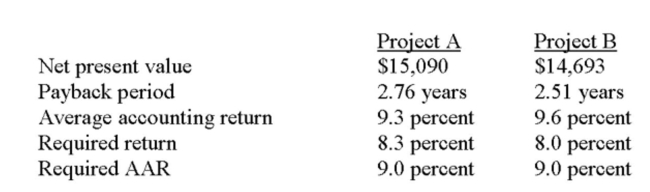

Matt is analyzing two mutually exclusive projects of similar size and has prepared the following data. Both projects have 5 year lives.  Matt has been asked for his best recommendation given this information. His recommendation

Matt has been asked for his best recommendation given this information. His recommendation

Should be to accept:

A) Project B because it has the shortest payback period.

B) Both projects as they both have positive net present values.

C) Project A and reject project B based on their net present values.

D) Project B and reject project A based on their average accounting returns.

E) Project B and reject project A based on both the payback period and the average accounting return.

Correct Answer:

Verified

Correct Answer:

Verified

Q117: A project which has a discounted payback

Q175: Bridgewater Fountains is considering expanding its current

Q177: A project will produce cash inflows of

Q178: You are considering two mutually exclusive projects

Q180: If a project with conventional cash flows

Q181: The discounted payback rule can be best

Q215: The average accounting return calculation takes the

Q265: The internal rate of return method of

Q322: The internal rate of return (IRR) rule

Q372: Determining whether to sell bonds or issue